Yes, Bonds are considered haram. According to Islamic scholars, engaging in the buying, selling, or trading of prize bonds within a business context is considered haram.

Are bonds haram? This is a question that has been debated amongst many in the financial world. Bonds are essentially loans made by individuals or institutions to companies or governments and involve interest payments over time. The debate arises from the fact that Islamic law forbids investing in any activity involving usury, or riba, which includes interest. So if a bond involves paying interest, does this make it haram?

What is Haram?

Haram finance is a type of financial activity that is considered to be contrary to the teachings of Islam. This can include activities such as usury (charging interest), gambling, and speculation.

While there is some debate among scholars as to what exactly constitutes haram finance, the general consensus is that any activity which involves excessive risk or speculation, or which results in the exploitation of others, is not permissible.

There are a number of reasons why haram finance is discouraged in Islam. First and foremost, it is seen as being contrary to the spirit of fair dealing and equity that is central to Islamic teachings.

Furthermore, engaging in haram activities can lead to financial instability and hardship, both for the individual and for the wider community. Finally, haram finance is often seen as being a form of exploitation, as it typically benefits those who are already wealthy at the expense of those who are poorer.

While there may be some debate about what does and does not constitute haram finance, there are a few activities that are generally considered to be off-limits. These include:

Usury (charging interest): Islam teaches that money should only be used for productive purposes, and that charging interest is a form of exploitation.

Gambling: Gambling is seen as a form of speculation, which is discouraged in Islam. Furthermore, it can lead to financial instability and hardship.

Speculation:Islam teaches that money should only be used for productive purposes, and that speculation is a form of gambling which can lead to financial instability and hardship.

Exploitation: Any activity which results in the exploitation of others, whether it is financial or otherwise, is not permissible in Islam. This includes activities such as slavery, child labour, and usury.

What Are Bonds?

Bonds are an effective way to diversify your investment portfolio and get a steady stream of income. When you buy a bond, you essentially lend money to the issuing institution or government in exchange for periodic payments (usually twice per year) and repayment of the principal on the maturity date.

Bonds can provide a secure source of income if held to maturity, and come in a variety of forms. Government bonds are considered the safest investments since the government is nearly always able to pay back its debts, while corporate bonds carry more risk but also offer higher returns.

Also Read: Is Insurance Haram?

Municipal bonds, or municipals, are issued by local governments and can have tax advantages to investors depending on their state of residence. Bonds come in all shapes and sizes, so it’s important to know what type of bond best fits your investment goals. With a little bit of research and advice from financial professionals, you can find the right bonds for your portfolio.

Bonds have unique characteristics that make them an attractive option for investors looking to diversify their holdings. They generally offer lower risk than stocks, and because of their fixed-income nature, you can know exactly what your return on investment will be.

Bonds also tend to be less volatile in the market since they are structured to pay a regular income stream, making them ideal for investors seeking steady returns over time. In addition, bonds may provide tax advantages depending on the type of bond in question and your tax situation. With the right knowledge and investment strategy, bonds can be an important part of a diversified portfolio.

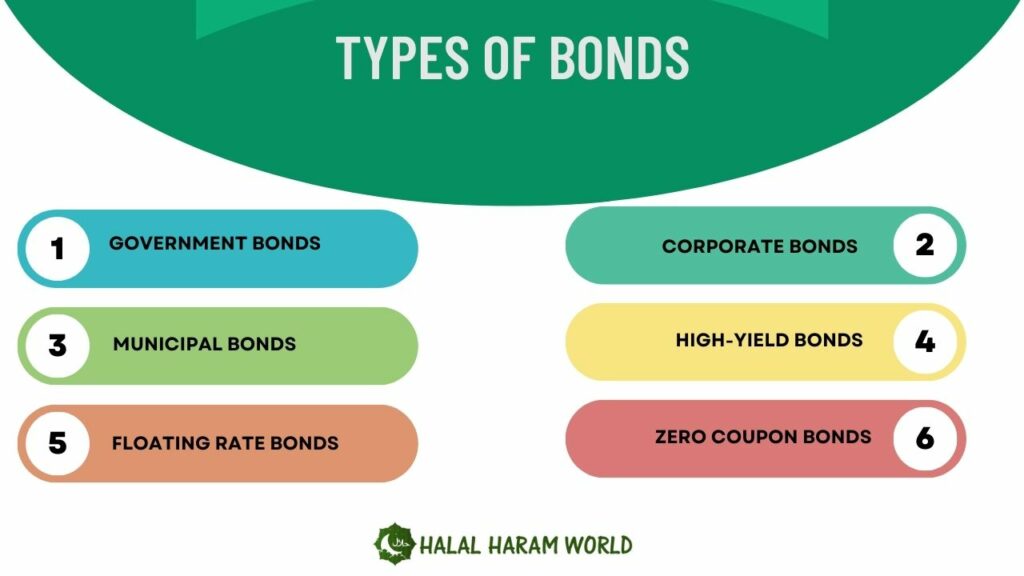

Types of Bonds

Bonds are a popular investment option for individuals and institutions looking to diversify their portfolios and earn a steady stream of income. But did you know that there are many different types of bonds to choose from? Understanding the different types of bonds can help you make informed investment decisions and reach your financial goals.

- Government Bonds: These bonds are issued by national or local governments and are considered to be low-risk investments. They offer a secure source of income and are often used as a benchmark for other types of bonds.

- Corporate Bonds: Corporate bonds are issued by companies and offer higher yields than government bonds. They are considered to be a bit riskier than government bonds, but can still provide a steady stream of income.

- Municipal Bonds: Municipal bonds are issued by local governments, such as cities or counties, and are used to finance public projects. They are often tax-free, making them an attractive option for investors in high tax brackets.

- High-Yield Bonds: Also known as junk bonds, high-yield bonds offer higher yields than other types of bonds, but come with a higher level of risk. They are issued by companies with lower credit ratings and are suitable for investors with a higher risk tolerance.

- Floating Rate Bonds: Floating rate bonds have an adjustable interest rate that changes based on a benchmark interest rate. They are designed to protect investors from rising interest rates and offer a flexible source of income.

- Zero Coupon Bonds: Zero coupon bonds do not pay periodic interest and are sold at a discount to their face value. They are long-term investments that offer a single payment at maturity.

Advantages of Investing in Bonds:

- Predictable income: Bonds offer a predictable source of income in the form of interest payments, making them an attractive option for those looking for a stable source of income.

- Diversification: Bonds can help diversify your investment portfolio, reducing your overall risk exposure.

- Safety: Bonds issued by governments and large, established companies are considered low-risk investments, making them a safe option for many investors.

Disadvantages of Investing in Bonds:

- Limited potential for growth: Bonds generally offer lower returns than other types of investments, such as stocks.

- Interest rate risk: Changes in interest rates can impact the value of bonds, making them a less predictable investment option.

- Credit risk: Bonds issued by companies or governments with lower credit ratings are considered higher risk and come with the potential for default.

Are Bonds Haram in Islam?

Investing in bonds is a popular way for investors to make money but, for Muslims, it can be a tricky choice. Bonds are generally seen as safe investments but what many people don’t know is that investing in certain types of bonds might actually be prohibited under Islamic law.

So what does this mean? Are all bonds haram or only certain types? To answer this question, it’s important to understand what makes bonds Haram in the eyes of Islamic law.

The most important consideration is whether the bond is a promise to pay interest in addition to the face value. This type of arrangement is known as “usury,” and is prohibited under Sharia law, since interest is considered haram. Bonds with stipulations attached, such as conditional benefits, may also be prohibited.

Therefore, for Muslims it is essential to ascertain whether a bond involves usury or not before investing in it. Many financial institutions offer Islamic bonds which comply with Sharia law so this is something worth considering if you are looking to invest in bonds from an Islamic perspective.

Source Reference – The above information is verified via Islam Question and Answer.

List of Halal Bonds

Here is a list of some types of halal bonds for Islam:

Asset-Backed Sukuk: This type of sukuk is based on ownership of tangible assets such as real estate, commodities, or infrastructure projects. Investors receive a portion of the profits generated by the underlying assets.

Istisna’a Sukuk: These are used to finance a specific project or contract. The issuer will use the proceeds to commission the construction or production of the underlying asset, and investors will receive a share of the profits from that asset.

Murabaha Sukuk: These sukuk are based on the concept of Murabaha, which involves the purchase and sale of goods at a markup. The issuer purchases goods with the proceeds from the sukuk, and then sells them to the investors at a higher price. The investors receive a share of the profits from the sale of those goods.

Musharakah Sukuk: This type of sukuk involves joint ownership of an asset or project, with investors sharing in the profits and losses. This structure aligns with Islamic principles of risk-sharing and encourages investment in real economic activities.

Wakala Sukuk: These are investment certificates that represent ownership in a pool of assets managed by a trustee. The trustee is responsible for investing the assets and distributing the profits to the investors.

Overall, halal bonds, or sukuk, are structured to comply with Islamic principles and avoid interest-based transactions. They provide a way for Islamic investors to participate in the global financial markets while adhering to their faith-based principles.

FAQ

Are all bonds haram?

What are the alternatives to bonds for Islamic investors?

How can I determine if a bond is haram or halal?

Conclusion

It is important to understand the complexities of investing in bonds from an Islamic perspective. While not all bonds are haram, there are certain types that may violate Islamic law and principles. It is therefore crucial to thoroughly evaluate each bond and its underlying principles before making an investment.

This requires research and a deep understanding of Islamic finance and its guidelines. With this knowledge, Muslims can invest in bonds in a manner that aligns with their values and beliefs, ensuring that they do not contravene Islamic law. By carefully considering the characteristics of each bond, Muslims can make informed investment decisions that balance financial goals with spiritual principles.

Also explore Is Health Insurance Haram, Are Credit Cards Haram or Halal, Are NFTs Haram and many more at Halal Haram World.